indiana excise tax alcohol

Apply for employment as an Indiana State Excise Police officer. In Indiana wine vendors are responsible for paying a state excise tax of 047 per gallon plus Federal excise taxes for all wine sold.

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

For beer they pay an extra 11 and one-half cents.

. An excise tax at the rate of two dollars and sixty-eight cents 268 a. Attend a certified server training program in my area. Do I need any type of permit to dispense alcoholic beverages at my one time event.

Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon. Excise Police Indiana State. Excise Police Indiana State 10 Articles.

House Bill 1604 would raise the excise tax on liquor beer and wine sales by 100. LIQUOR EXCISE TAX IC 71-4-3 Chapter 3. What happens if I sell tobacco without.

This 42 million tax hike alone would cause the price of distilled spirits to rise by 7 and would. Indiana Alcoholic Beverage Permit Numbers Section B. Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1.

And for wine the pay an extra 47 cents. Over 21 - 268gallon Ranked 40th. Alcoholic Beverage Excise Tax The alcoholic beverage excise tax is imposed on all alcoholic beverages at a per-gallon rate paid by Brewers Wholesalers and Permittees in Indiana.

Have a State Excise Officer speak at my school or organization. Physical AddressCityStateZIP Indiana Tax Identification Number Mailing AddressCityStateZIP Telephone Number Business Web Address Indiana Alcoholic Beverage Permit Numbers. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

The paper forms with instructions shown below are available so customers can visualize what is required. 2016 indiana code title 71. State Excise police officers are empowered by statute to enforce the.

The Indiana State Excise Police is the law enforcement division of the Indiana Alcohol and Tobacco Commission. Alcohol and tobacco article 4. Liquor Excise Tax IC 71-4-3-1 Rate of tax Sec.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Revenue and taxes chapter 3. Liquor excise tax download as pdf.

Indianas general sales tax of 7 also applies to the. Visit Electronic Filing for Alcohol Taxpayers for filing information. 3 rows Indiana Liquor Tax - 268 gallon.

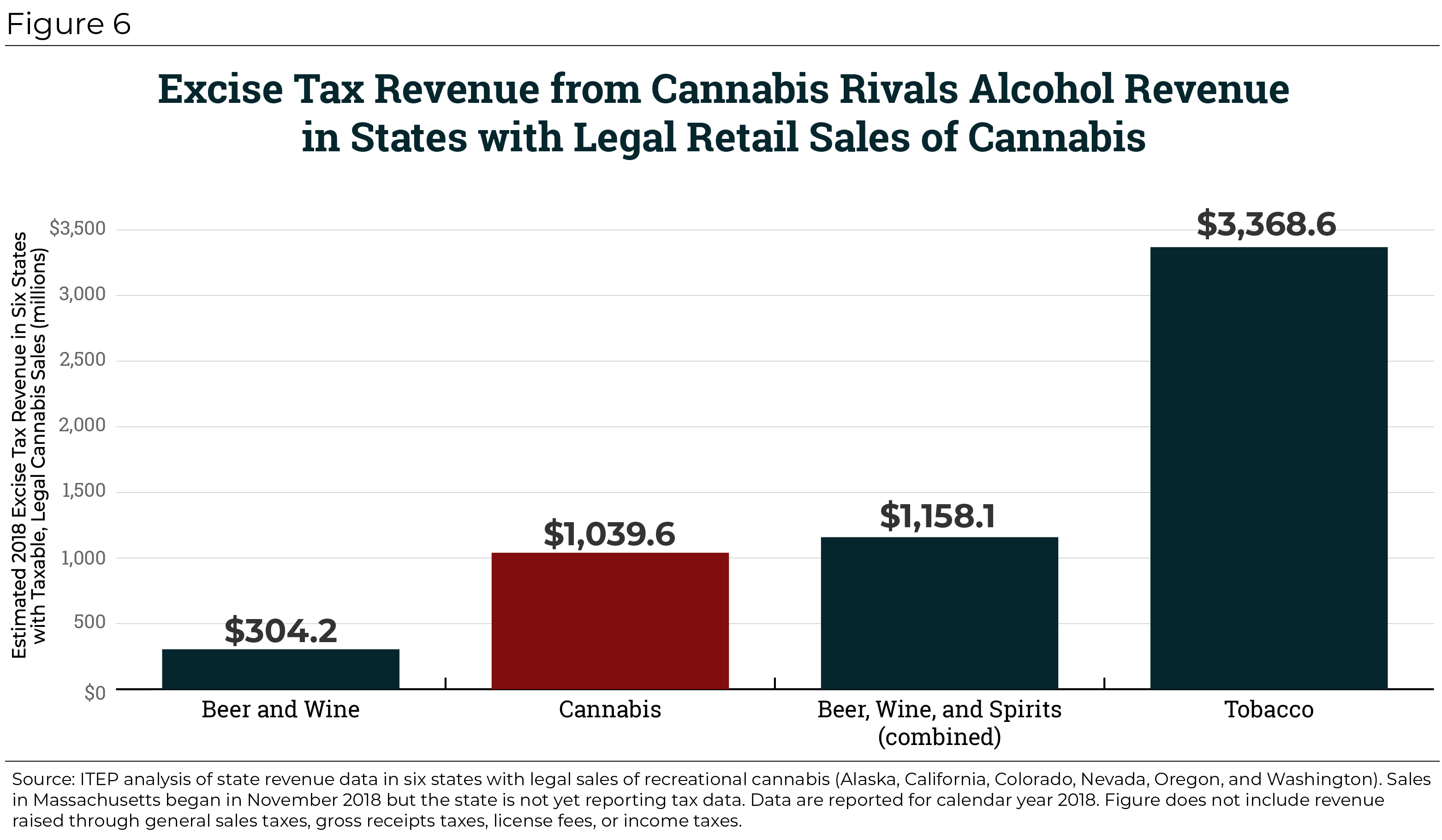

Alcohol Taxes On Beer Wine Spirits Federal State

Alcohol Taxes On Beer Wine Spirits Federal State

Opposition Building Against Raising Excise Taxes On Liquor Beer And Wine Illinois Thecentersquare Com

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Indiana Liquor Store Facing Federal Bootlegging Charges

Alcohol Taxes On Beer Wine Spirits Federal State

Last Call New York Bill Would Double State Excise Tax Indiana Cold Beer Sales Effort To Resume Brewbound

Kentucky Alcohol Taxes Liquor Wine And Beer Taxes For 2022

How Alcohol Taxes Figure Into Your Margarita Day Celebration Don T Mess With Taxes

Alcohol Sales In Indiana And New Liquor Legislation Overproof

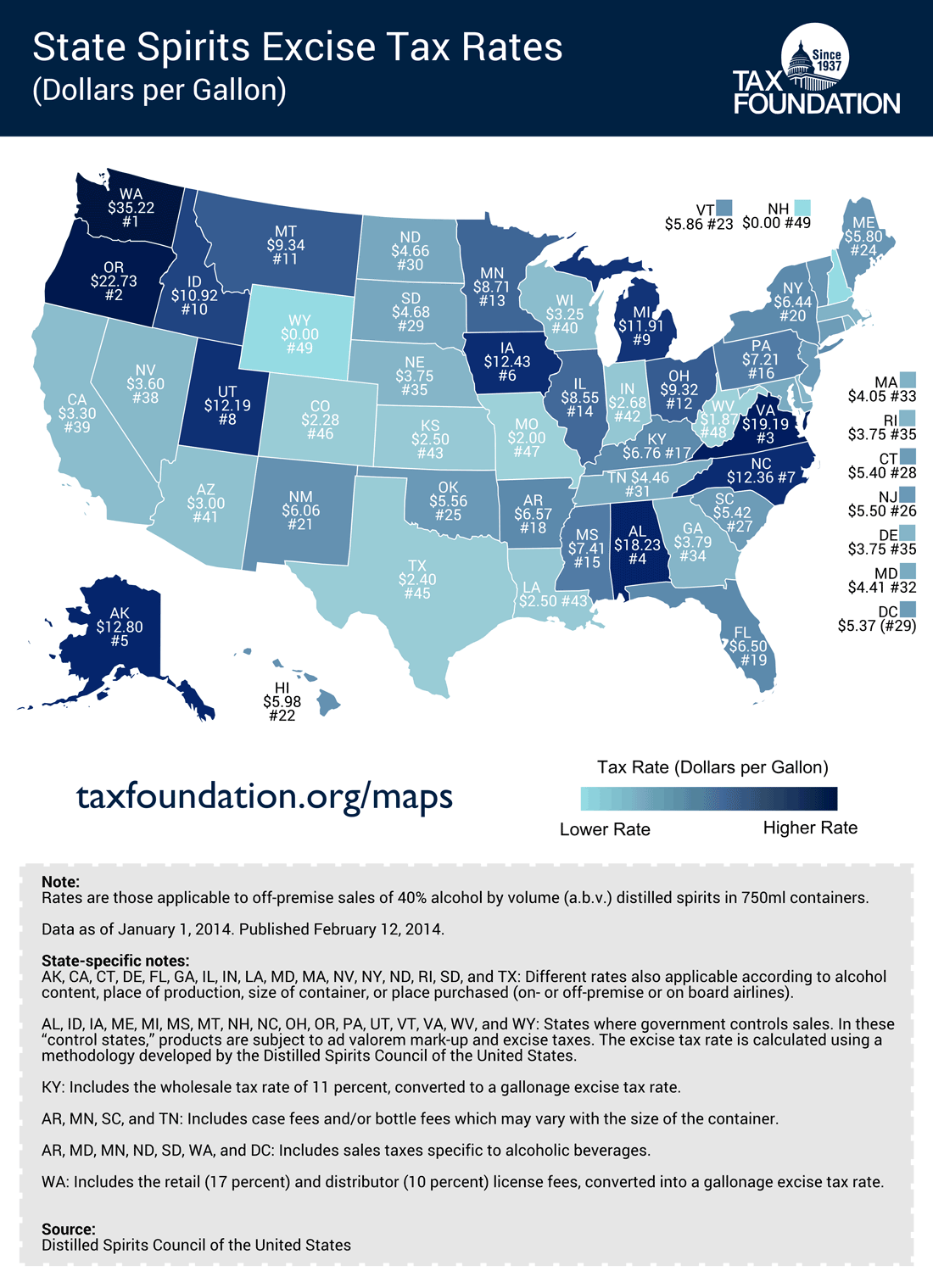

Map Spirits Excise Tax Rates By State 2014 Tax Foundation

North Carolina Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Average Real Federal Excise Taxes In Dollars Per Barrel On Alcoholic Download Scientific Diagram

Opposition Building Against Raising Excise Taxes On Liquor Beer And Wine Illinois Thecentersquare Com

How High Are Spirits Excise Taxes In Your State

Alcohol Taxes On Beer Wine Spirits Federal State

Vintage Bardenheier S Amber Wine 4 5 Quart Grape Bottle Indiana Excise Tax Stamp Ebay